Loan Quality Assurance Auditor Average Salary in Oman 2024

How much money does a person working as Loan Quality Assurance Auditor make in Oman?

LOW

940

OMR AVERAGE

1,870

OMR HIGH

2,900

OMR

A person working as Loan Quality Assurance Auditor in Oman typically earns around 1,870 OMR. Salaries range from 940 OMR (lowest) to 2,900 OMR (highest).

Salary Variance

This is the average salary including housing, transport, and other benefits. Loan Quality Assurance Auditor salaries in Oman vary drastically based on experience, skills, gender, or location. Below you will find a detailed breakdown based on many different criteria.

Loan Quality Assurance Auditor Pay Scale and Salaries in Oman

Salary Structure and Pay Scale Comparison

1,720 OMR or more

1,530 to 1,720 OMR

1,090 OMR or less

1,090 to 1,530 OMR

940 OMR |

1,730 OMR |

2,900 OMR |

Median Salary, maximum and minimum salary, minimum wage, starting salary, and the salary range

Salary Range, Minimum Wage, and Starting Salary

Salaries for the position Loan Quality Assurance Auditor in Oman range from 940 OMR (starting salary) to 2,900 OMR (maximum salary). It should be noted that the given figure is not the legally mandated minimum wage; rather, it represents the lowest figure reported in a salary survey that included thousands of participants and professionals from all regions of the country.

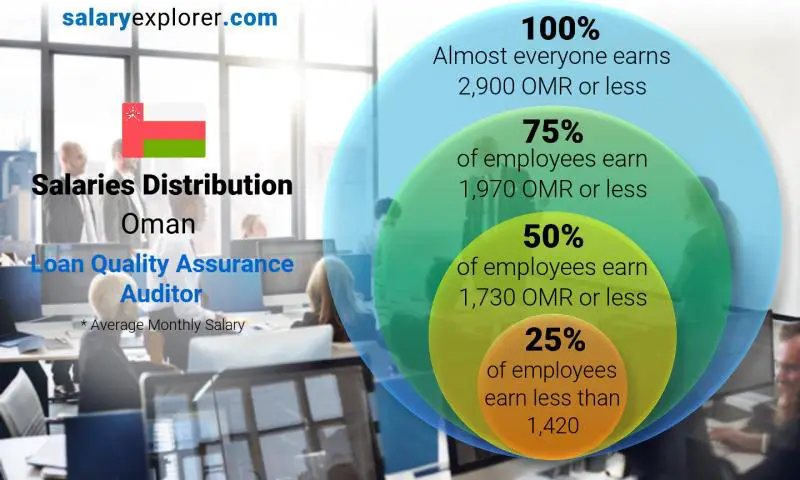

Median Salary

With a median salary of 1,730 OMR, half of the professionals who work as Loan Quality Assurance Auditor in Oman earn less than this amount, and the other half earn more. The median salary denotes the middle value of salaries. Ideally, you would want to belong to the group earning more than the median salary, located on the right side of the salary distribution graph.

Percentiles and Salary Scale

The median is closely associated with two other values known as the 25th and 75th percentiles. By examining the salary distribution chart, it can be determined that 25% of professionals employed as Loan Quality Assurance Auditor in Oman earn less than 1,420 OMR, while 75% earn more. Similarly, the chart shows that 75% earn less than 1,970 OMR while 25% earn more.

Pay Scale Structure

To provide a better understanding of expected salaries, we categorized the frequently occurring salaries into different ranges. This approach provides a more precise representation of salary distribution for the job title Loan Quality Assurance Auditor in Oman compared to simply calculating the average. The majority of reported salaries, approximately 65%, fall within the range of 1,090 OMR to 1,530 OMR. About 20% of salaries are below the 1,090 OMR mark, while 10% fall within the range of 1,530 OMR to 1,720 OMR. Only 5% of individuals have salaries exceeding 1,720 OMR.

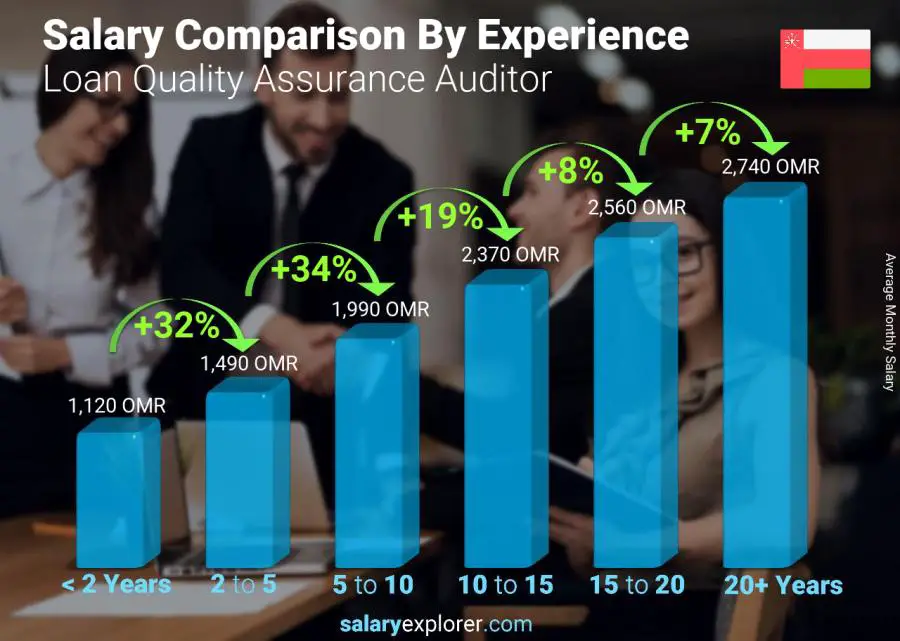

Salary Comparison by Years of Experience / Loan Quality Assurance Auditor / Oman

How do experience and age affect pay?

| 0 - 2 Years | 1,120 OMR | |

| 2 - 5 Years | +32% | 1,490 OMR |

| 5 - 10 Years | +34% | 1,990 OMR |

| 10 - 15 Years | +19% | 2,370 OMR |

| 15 - 20 Years | +8% | 2,560 OMR |

| 20+ Years | +7% | 2,740 OMR |

The experience level is the most important factor in determining the salary. Naturally, the more years of experience the higher the wage. We broke down salaries by experience level for people working as Loan Quality Assurance Auditor and this is what we found.

Employees with less than two years of experience earn approximately 1,120 OMR.

While someone with an experience level between two and five years is expected to earn 1,490 OMR, 32% more than someone with less than two year's experience.

Moving forward, an experience level between five and ten years lands a salary of 1,990 OMR, 34% more than someone with two to five years of experience.

Additionally, professionals whose expertise span anywhere between ten and fifteen years get a salary equivalent to 2,370 OMR, 19% more than someone with five to ten years of experience.

If the experience level is between fifteen and twenty years, then the expected wage is 2,560 OMR, 8% more than someone with ten to fifteen years of experience.

Lastly, employees with more than twenty years of professional experience get a salary of 2,740 OMR, 7% more than people with fifteen to twenty years of experience.

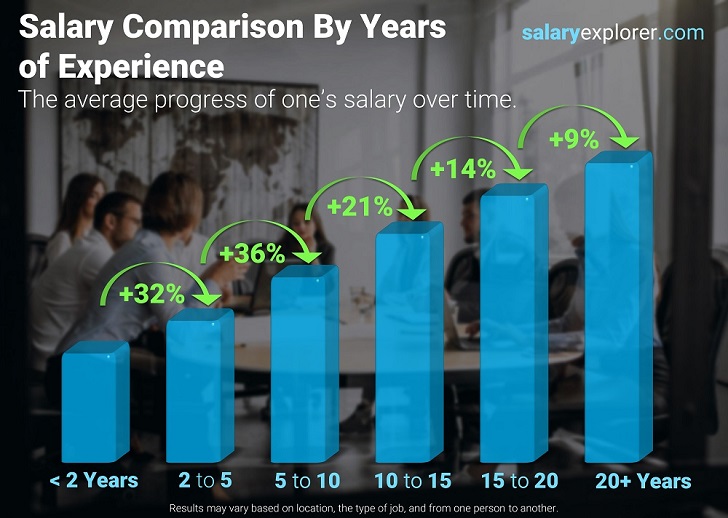

Typical Salary Progress for Most Careers

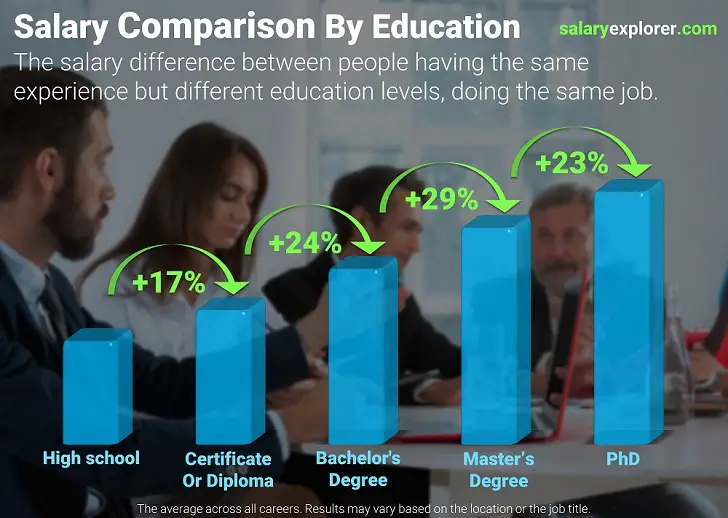

Salary Comparison By Education / Loan Quality Assurance Auditor / Oman

How do education levels affect salaries?

Displayed below is the average salary variance between different education levels of professionals working as Loan Quality Assurance Auditor.

| Bachelor's Degree | 1,600 OMR | |

| Master's Degree | +58% | 2,530 OMR |

We all know that higher education equals a bigger salary, but how much more money can a degree add to your income? We broke down salaries by education level for the position Loan Quality Assurance Auditor in order to make a comparison.

Level 1: Bachelor's Degree

Employees at this education level have an average salary of 1,600 OMR.

Level 2: Master's Degree

At this level, the average salary becomes 2,530 OMR, 58% more than the previous level.

Is a Master's degree or an MBA worth it? Should you pursue higher education?

A Master's degree program or any post-graduate program in Oman costs anywhere from 8,880 OMR to 26,600 OMR and lasts approximately two years. That is quite an investment.

You can't really expect any salary increases during the study period, assuming you already have a job. In most cases, a salary review is conducted once education is completed and the degree has been attained.

Many people pursue higher education as a tactic to switch to a higher-paying job. The numbers seem to support the theory. The average increase in compensation while changing jobs is approximately 10% more than the customary salary increment.

If you can afford the costs of higher education, the return on investment is definitely worth it. You should be able to recover the costs in roughly a year or so.

Typical Salary Difference by Education for Most Careers

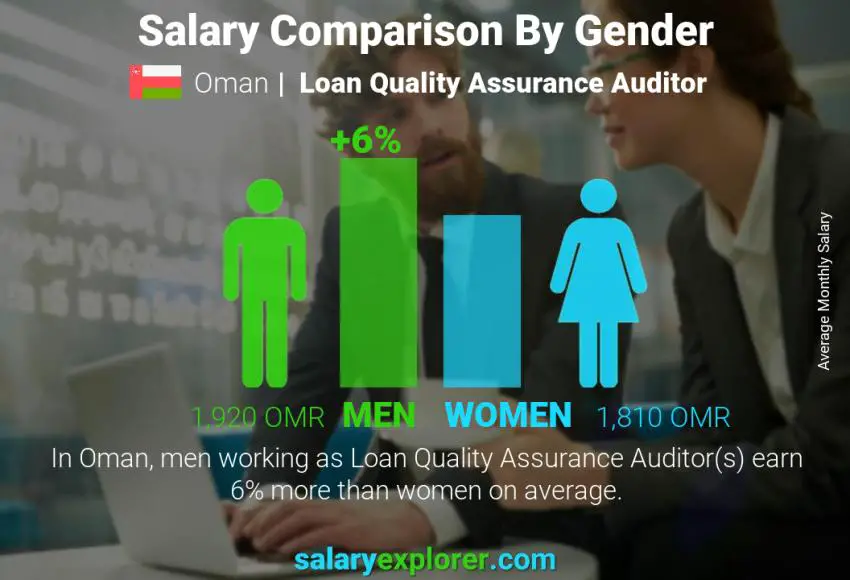

Salary and Compensation Comparison By Gender / Loan Quality Assurance Auditor / Oman

Though gender should not have an effect on pay, in reality, it does. So who gets paid more: men or women? For the people who work as Loan Quality Assurance Auditor in Oman, the average difference between the salary of male and female employees is 6%.

| Male | 1,920 OMR | |

| Female | -6% | 1,810 OMR |

Salary Comparison By Gender in Oman for all Careers

Average Annual Salary Increment Percentage / Loan Quality Assurance Auditor / Oman

How much are annual salary increments in Oman for individuals working as Loan Quality Assurance Auditor? How often do employees get salary raises?

Individuals working as Loan Quality Assurance Auditor in Oman are likely to observe a salary increase of approximately 11% every 18 months. The national average annual increment for all professions combined is 7% granted to employees every 19 months.

Oman / All Professions

The term Annual Salary Increase usually refers to the increase in 12 calendar month period, but because it is rare that people get their salaries reviewed exactly on the one-year mark, it is more meaningful to know the frequency and the rate at the time of the increase.

How to calculate the salary increment percentage?

The annual salary Increase in a calendar year (12 months) can be easily calculated as follows: Annual Salary Increase = Increase Rate x 12 / Increase Frequency

Worldwide Salary Raises: All Countries and All Jobs

Salary Packages and Schemes

Not all compensation increases are reflected directly in the salary. Some companies offer upgraded packages to their staff instead of cash money. The figures displayed here account only for direct increments to the base salary.

Bonus and Incentive Rates / Loan Quality Assurance Auditor / Oman

How much and how often are bonuses being awarded? Share This Chart Tweet Get Chart Linkhttp://www.salaryexplorer.com/charts/oman/banking/loan-quality-assurance-auditor/annual-salary-bonus-rate-oman-loan-quality-assurance-auditor.jpg

Share This Chart Tweet Get Chart Linkhttp://www.salaryexplorer.com/charts/oman/banking/loan-quality-assurance-auditor/annual-salary-bonus-rate-oman-loan-quality-assurance-auditor.jpg

23% of surveyed staff reported that they haven't received any bonuses or incentives in the previous year while 77% said that they received at least one form of monetary bonus.

Those who got bonuses reported rates ranging from 5% to 8% of their annual salary.

| Received Bonus | 77% | |

| No Bonus | 23% |

Types of Bonuses Considered

Individual Performance-Based BonusesThe most standard form of bonus, where the employee is awarded based on their exceptional performance.

Company Performance BonusesOccasionally, some companies like to celebrate excess earnings and profits with their staff collectively in the form of bonuses that are granted to everyone. The amount of the bonus will probably be different from person to person depending on their role within the organization.

Goal-Based BonusesGranted upon achieving an important goal or milestone.

Holiday / End of Year BonusesThese types of bonuses are given without a reason and usually resemble an appreciation token.

Bonuses Are Not Commissions!

People tend to confuse bonuses with commissions. A commission is a prefixed rate at which someone gets paid for items sold or deals completed while a bonus is in most cases arbitrary and unplanned.

What makes a position worthy of good bonuses and a high salary?

The main two types of jobs | |

| Revenue Generators | Supporting Cast |

Employees that are directly involved in generating revenue or profit for the organization. Their field of expertise usually matches the type of business. | Employees that support and facilitate the work of revenue generators. Their expertise is usually different from that of the core business operations. |

Example: | Example: |

Revenue generators usually get more and higher bonuses, higher salaries, and more frequent salary increments. The reason is quite simple: it is easier to quantify your value to the company in monetary terms when you participate in revenue generation.

Bonus Comparison by Seniority Level

Top management personnel and senior employees naturally exhibit higher bonus rates and frequencies than juniors. This is very predictable due to the inherent responsibilities of being higher in the hierarchy. People in top positions can easily get double or triple bonus rates than employees down the pyramid.

Average Hourly Wage / Loan Quality Assurance Auditor / Oman

11 OMR per hour

11 OMR per hourThe average hourly wage (pay per hour) for individuals working as Loan Quality Assurance Auditor in Oman is 11 OMR.This is the rate they get paid for every worked hour.

About The Hourly Pay Rate

The hourly wage is the salary paid in one worked hour. Usually, jobs are classified into two categories: salaried jobs and hourly jobs. Salaried jobs pay a fixed amount regardless of the hours worked. Hourly jobs pay per worked hour. To convert salary into hourly wage the above formula is used (assuming 5 working days in a week and 8 working hours per day which is the standard for most jobs). The hourly wage calculation may differ slightly depending on the worked hours per week and the annual vacation allowance. The figures mentioned above are good approximations and are considered to be the standard. One major difference between salaried employees and hourly paid employees is overtime eligibility. Salaried employees are usually exempt from overtime as opposed to hourly paid staff.

What is the minimum hourly rate of pay?

The minimum pay rate per hour for people working as Loan Quality Assurance Auditor in Oman is 5 OMR. This is the minimum as per the gathered data in the salary survey not the minimum hourly rate mandated by law.

Salary comparison with similar jobs

| Job Title | Average Salary |

| Banking |  -100% -100% | |

| AML Analyst | 2,630 OMR |  +40% +40% |

| Assistant Bank Branch Manager | 2,340 OMR |  +25% +25% |

| Assistant Bank Manager | 3,150 OMR |  +68% +68% |

| ATM Manager | 2,570 OMR |  +37% +37% |

| ATM Service Technician | 680 OMR |  -64% -64% |

| Bank Accounts Analyst | 1,030 OMR |  -45% -45% |

| Bank Accounts Collector | 640 OMR |  -66% -66% |

| Bank Accounts Controller | 1,240 OMR |  -34% -34% |

| Bank Accounts Executive | 1,970 OMR |  +5% +5% |

| Bank Accounts Manager | 2,200 OMR |  +18% +18% |

| Bank Auditing Manager | 2,340 OMR |  +25% +25% |

| Bank Branch Manager | 3,000 OMR |  +60% +60% |

| Bank Branch Operations Coordinator | 1,410 OMR |  -25% -25% |

| Bank Clerk | 600 OMR |  -68% -68% |

| Bank Client Service Associate | 870 OMR |  -54% -54% |

| Bank Collector | 630 OMR |  -66% -66% |

| Bank Compliance Specialist | 1,580 OMR |  -16% -16% |

| Bank Manager | 3,630 OMR |  +94% +94% |

| Bank Operational Risk Manager | 3,590 OMR |  +92% +92% |

| Bank Operations Head | 3,610 OMR |  +93% +93% |

| Bank Operations Officer | 1,400 OMR |  -25% -25% |

| Bank Operations Specialist | 2,180 OMR |  +16% +16% |

| Bank Process Manager | 2,080 OMR |  +11% +11% |

| Bank Product Manager | 2,450 OMR |  +31% +31% |

| Bank Programme Manager | 2,560 OMR |  +37% +37% |

| Bank Project Manager | 3,010 OMR |  +61% +61% |

| Bank Propositions Manager | 2,740 OMR |  +46% +46% |

| Bank Quantitative Analyst | 1,890 OMR |  +1% +1% |

| Bank Regional Manager | 3,650 OMR |  +95% +95% |

| Bank Regional Risk Officer | 1,980 OMR |  +6% +6% |

| Bank Relationship Manager | 2,850 OMR |  +52% +52% |

| Bank Relationship Officer | 1,270 OMR |  -32% -32% |

| Bank Sustainability Analyst | 2,130 OMR |  +14% +14% |

| Bank Teller | 630 OMR |  -66% -66% |

| Banker | 1,360 OMR |  -27% -27% |

| Banking Business Analyst | 1,930 OMR |  +3% +3% |

| Banking Business Development Officer | 1,210 OMR |  -35% -35% |

| Banking Business Planning Executive | 2,670 OMR |  +43% +43% |

| Banking Data Analyst | 2,100 OMR |  +12% +12% |

| Banking Product Manager | 2,350 OMR |  +26% +26% |

| Banking Reference Data Manager | 2,100 OMR |  +12% +12% |

| Banking Regulatory Compliance Officer | 2,300 OMR |  +23% +23% |

| Banking Risk Analyst | 1,960 OMR |  +5% +5% |

| Banking Technical Analyst | 1,010 OMR |  -46% -46% |

| Bankruptcy Coordinator | 1,380 OMR |  -26% -26% |

| Bill and Account Collector | 700 OMR |  -63% -63% |

| Blockchain Analyst | 1,680 OMR |  -10% -10% |

| Blockchain Architect | 1,880 OMR |  +0% +0% |

| Blockchain Auditor | 1,600 OMR |  -15% -15% |

| Blockchain Compliance Analyst | 1,760 OMR |  -6% -6% |

| Blockchain Consultant | 1,780 OMR |  -5% -5% |

| Blockchain Trade Facilitator | 1,570 OMR |  -16% -16% |

| Budget Analyst | 1,860 OMR |  -1% -1% |

| Capital Risk Manager | 3,700 OMR |  +98% +98% |

| Cards Marketing Manager | 2,420 OMR |  +29% +29% |

| Cash Management Manager | 3,260 OMR |  +74% +74% |

| Check Processing Manager | 2,570 OMR |  +37% +37% |

| Chief Blockchain Officer | 2,090 OMR |  +12% +12% |

| Commercial Vault Associate | 1,810 OMR |  -3% -3% |

| Corporate Banker | 1,340 OMR |  -28% -28% |

| Corporate Dealer | 1,910 OMR |  +2% +2% |

| Credit Analyst | 1,520 OMR |  -19% -19% |

| Credit and Collections Manager | 2,550 OMR |  +36% +36% |

| Credit Card Fraud Investigator | 1,880 OMR |  +0% +0% |

| Credit Portfolio Manager | 3,500 OMR |  +87% +87% |

| Credit Risk Analyst | 2,080 OMR |  +11% +11% |

| Credit Risk Associate | 1,990 OMR |  +6% +6% |

| Cryptocurrency Accountant | 1,160 OMR |  -38% -38% |

| Cryptocurrency Adviser | 2,410 OMR |  +29% +29% |

| Cryptocurrency Analyst | 1,740 OMR |  -7% -7% |

| Cryptocurrency Compliance Manager | 2,300 OMR |  +23% +23% |

| Cryptocurrency Trader | 1,980 OMR |  +6% +6% |

| Digital Banking Manager | 2,580 OMR |  +38% +38% |

| Digital Currency Analyst | 1,920 OMR |  +3% +3% |

| Direct Bank Sales Representative | 1,370 OMR |  -27% -27% |

| Exchange Control Consultant | 2,090 OMR |  +12% +12% |

| Executive Account Analyst | 1,930 OMR |  +3% +3% |

| Financial Bank Planning Consultant | 2,510 OMR |  +34% +34% |

| Financial Banking Analysis Manager | 2,930 OMR |  +57% +57% |

| Financial Banking Assistant | 920 OMR |  -51% -51% |

| Financial Banking Systems Manager | 2,520 OMR |  +35% +35% |

| Foreign Exchange Manager | 2,870 OMR |  +53% +53% |

| Fraud Analyst | 2,120 OMR |  +13% +13% |

| Fraud Detection Associate | 1,370 OMR |  -27% -27% |

| Fraud Detection Manager | 2,920 OMR |  +56% +56% |

| Fraud Detection Supervisor | 1,590 OMR |  -15% -15% |

| Internal Bank Audit Manager | 3,410 OMR |  +82% +82% |

| Internal Bank Auditor | 1,930 OMR |  +3% +3% |

| Internal Private Banker | 1,350 OMR |  -28% -28% |

| International Banking Manager | 3,940 OMR |  +110% +110% |

| Investment Banking Analyst | 2,800 OMR |  +50% +50% |

| Loan Analyst | 1,890 OMR |  +1% +1% |

| Loan Area Manager | 2,410 OMR |  +29% +29% |

| Loan Audit Team Leader | 2,250 OMR |  +20% +20% |

| Loan Branch Manager | 2,150 OMR |  +15% +15% |

| Loan Business Development Officer | 1,120 OMR |  -40% -40% |

| Loan Clerk | 700 OMR |  -63% -63% |

| Loan Collection and Recovery Manager | 2,190 OMR |  +17% +17% |

| Loan Collection Manager | 2,270 OMR |  +21% +21% |

| Loan Collector | 640 OMR |  -66% -66% |

| Loan Examiner | 820 OMR |  -56% -56% |

| Loan Officer | 750 OMR |  -60% -60% |

| Loan Processing Manager | 2,150 OMR |  +15% +15% |

| Loan Processor | 860 OMR |  -54% -54% |

| Loan Quality Assurance Auditor | 1,870 OMR |  -0% -0% |

| Loan Quality Assurance Manager | 2,220 OMR |  +19% +19% |

| Loan Quality Assurance Representative | 1,430 OMR |  -24% -24% |

| Loan Review Manager | 2,070 OMR |  +11% +11% |

| Loan Team Leader | 1,970 OMR |  +5% +5% |

| Loans Manager | 2,580 OMR |  +38% +38% |

| Mortgage Advisor | 1,310 OMR |  -30% -30% |

| Mortgage Collection Manager | 2,340 OMR |  +25% +25% |

| Mortgage Collector | 630 OMR |  -66% -66% |

| Mortgage Credit Analyst | 990 OMR |  -47% -47% |

| Mortgage Credit Manager | 2,210 OMR |  +18% +18% |

| Mortgage Development Manager | 2,450 OMR |  +31% +31% |

| Mortgage Document Reviewer | 800 OMR |  -57% -57% |

| Mortgage Funding Manager | 2,540 OMR |  +36% +36% |

| Mortgage Operations Manager | 3,440 OMR |  +84% +84% |

| Mortgage Payment Processing Clerk | 730 OMR |  -61% -61% |

| Mortgage Processing Manager | 2,160 OMR |  +15% +15% |

| Mortgage Processor | 820 OMR |  -56% -56% |

| Mortgage Quality Assurance Auditor | 1,820 OMR |  -3% -3% |

| Mortgage Quality Assurance Manager | 2,220 OMR |  +19% +19% |

| Mortgage Servicing Clerk | 670 OMR |  -64% -64% |

| Mortgage Servicing Manager | 2,060 OMR |  +10% +10% |

| Mortgage Underwriter | 800 OMR |  -57% -57% |

| Online Banking Manager | 3,220 OMR |  +72% +72% |

| Open Banking Strategist | 2,020 OMR |  +8% +8% |

| Payment Processing Clerk | 700 OMR |  -63% -63% |

| Personal Banker | 1,330 OMR |  -29% -29% |

| Personal Banking Advisor | 1,430 OMR |  -24% -24% |

| Phone Banker | 900 OMR |  -52% -52% |

| Private Banker | 1,380 OMR |  -26% -26% |

| Reconciliation and Investigation Specialist | 1,550 OMR |  -17% -17% |

| Tax Officer | 1,160 OMR |  -38% -38% |

| Teller | 640 OMR |  -66% -66% |

| Trade Officer | 780 OMR |  -58% -58% |

| Trade Product Manager | 2,160 OMR |  +15% +15% |

| Trader | 970 OMR |  -48% -48% |

| Treasury Operations Officer | 1,710 OMR |  -9% -9% |

| Wealth Management Advisor | 2,760 OMR |  +47% +47% |

Government vs Private Sector Salary Comparison

Where can you get paid more, working in a private company or the government? The difference between the public or government sector salaries and the private sector salaries in Oman is 7% on average across all career fields.

| Private Sector | 1,700 OMR | |

| Public Sector | +7% | 1,830 OMR |

Salary Statistics and Calculation Guide

What is considered to be a good and competitive salary for the job title Loan Quality Assurance Auditor in Oman?

A good and competitive compensation would range anywhere between 1,730 OMR and 1,970 OMR. This is a very rough estimate. Experience and education play a very huge part in the final earnings.

Gross Salary (before tax) and Net Salary (after tax)

All salary and compensation figures displayed here are gross salary figures, that is the salary before tax deductions. Because taxes may differ across sectors and locations, it is difficult to accurately calculate the net salary after tax for every career.

Base / Basic Salary

The base salary for a careers like Loan Quality Assurance Auditor in Oman ranges from 940 OMR to 1,420 OMR. The base salary depends on many factors including experience and education. It is not easy to provide a figure with very little information, so take this range with a grain of salt.

What is the difference between the median and the average salary?

Both are indicators. If your salary is higher than both the average and the median then you are doing very well. If your salary is lower than both, then many people earn more than you and there is plenty of room for improvement. If your wage is between the average and the median, then things can be a bit complicated. We wrote a guide to explain all about the different scenarios. How to compare your salary