Financial Analyst Average Salary in United States 2024

How much money does a person working as Financial Analyst make in United States?

LOW

66,600

USD AVERAGE

126,000

USD HIGH

191,000

USD

A person working as Financial Analyst in United States typically earns around 126,000 USD. Salaries range from 66,600 USD (lowest) to 191,000 USD (highest).

Salary Variance

This is the average salary including housing, transport, and other benefits. Financial Analyst salaries in United States vary drastically based on experience, skills, gender, or location. Below you will find a detailed breakdown based on many different criteria.

Financial Analyst Pay Scale and Salaries in United States

Salary Structure and Pay Scale Comparison

113,000 USD or more

101,000 to 113,000 USD

74,300 USD or less

74,300 to 101,000 USD

66,600 USD |

113,000 USD |

191,000 USD |

Median Salary, maximum and minimum salary, minimum wage, starting salary, and the salary range

Salary Range, Minimum Wage, and Starting Salary

Salaries for the position Financial Analyst in United States range from 66,600 USD (starting salary) to 191,000 USD (maximum salary). It should be noted that the given figure is not the legally mandated minimum wage; rather, it represents the lowest figure reported in a salary survey that included thousands of participants and professionals from all regions of the country.

Median Salary

With a median salary of 113,000 USD, half of the professionals who work as Financial Analyst in United States earn less than this amount, and the other half earn more. The median salary denotes the middle value of salaries. Ideally, you would want to belong to the group earning more than the median salary, located on the right side of the salary distribution graph.

Percentiles and Salary Scale

The median is closely associated with two other values known as the 25th and 75th percentiles. By examining the salary distribution chart, it can be determined that 25% of professionals employed as Financial Analyst in United States earn less than 94,400 USD, while 75% earn more. Similarly, the chart shows that 75% earn less than 128,000 USD while 25% earn more.

Pay Scale Structure

To provide a better understanding of expected salaries, we categorized the frequently occurring salaries into different ranges. This approach provides a more precise representation of salary distribution for the job title Financial Analyst in United States compared to simply calculating the average. The majority of reported salaries, approximately 65%, fall within the range of 74,300 USD to 101,000 USD. About 20% of salaries are below the 74,300 USD mark, while 10% fall within the range of 101,000 USD to 113,000 USD. Only 5% of individuals have salaries exceeding 113,000 USD.

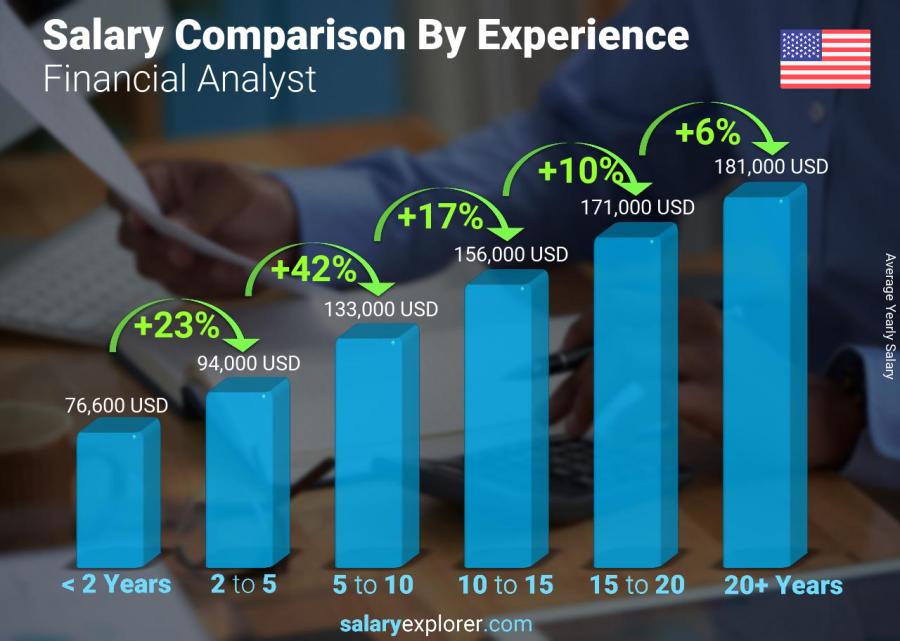

Salary Comparison by Years of Experience / Financial Analyst / United States

How do experience and age affect pay?

| 0 - 2 Years | 76,600 USD | |

| 2 - 5 Years | +23% | 94,000 USD |

| 5 - 10 Years | +42% | 133,000 USD |

| 10 - 15 Years | +17% | 156,000 USD |

| 15 - 20 Years | +10% | 171,000 USD |

| 20+ Years | +6% | 181,000 USD |

The experience level is the most important factor in determining the salary. Naturally, the more years of experience the higher the wage. We broke down salaries by experience level for people working as Financial Analyst and this is what we found.

Employees with less than two years of experience earn approximately 76,600 USD.

While someone with an experience level between two and five years is expected to earn 94,000 USD, 23% more than someone with less than two year's experience.

Moving forward, an experience level between five and ten years lands a salary of 133,000 USD, 42% more than someone with two to five years of experience.

Additionally, professionals whose expertise span anywhere between ten and fifteen years get a salary equivalent to 156,000 USD, 17% more than someone with five to ten years of experience.

If the experience level is between fifteen and twenty years, then the expected wage is 171,000 USD, 10% more than someone with ten to fifteen years of experience.

Lastly, employees with more than twenty years of professional experience get a salary of 181,000 USD, 6% more than people with fifteen to twenty years of experience.

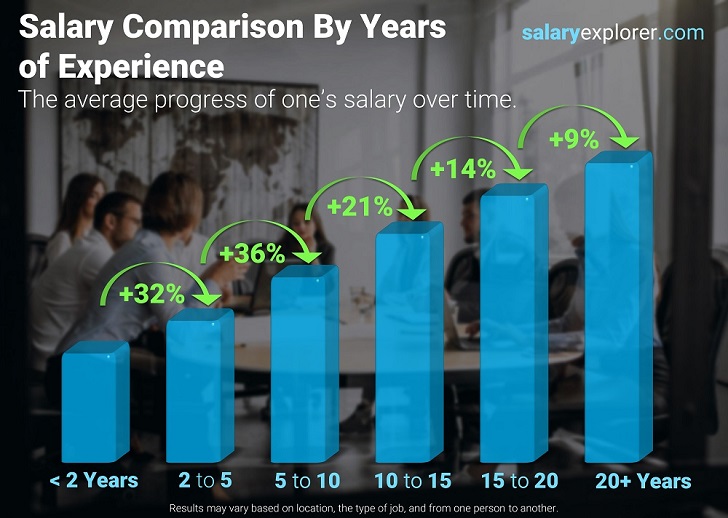

Typical Salary Progress for Most Careers

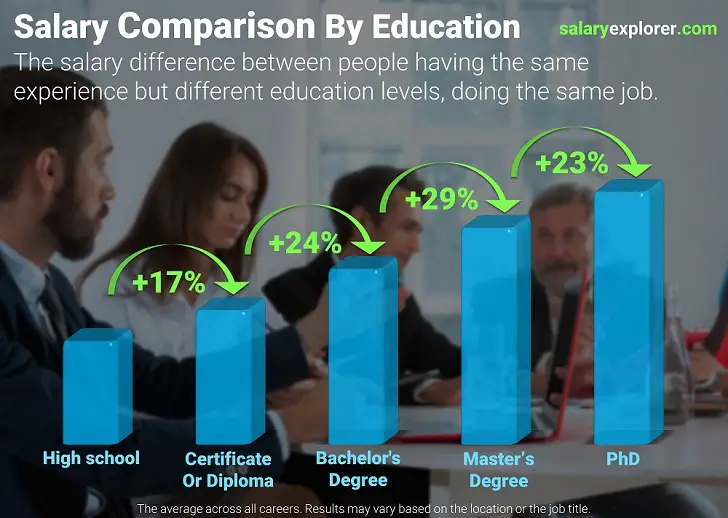

Salary Comparison By Education / Financial Analyst / United States

How do education levels affect salaries?

Displayed below is the average salary variance between different education levels of professionals working as Financial Analyst.

| High School | 92,800 USD | |

| Certificate or Diploma | +13% | 105,000 USD |

| Bachelor's Degree | +31% | 138,000 USD |

| Master's Degree | +32% | 181,000 USD |

We all know that higher education equals a bigger salary, but how much more money can a degree add to your income? We broke down salaries by education level for the position Financial Analyst in order to make a comparison.

Level 1: High School

Employees at this education level have an average salary of 92,800 USD.

Level 2: Certificate or Diploma

At this level, the average salary becomes 105,000 USD, 13% more than the previous level.

Level 3: Bachelor's Degree

At this level, the average salary becomes 138,000 USD, 31% more than the previous level.

Level 4: Master's Degree

At this level, the average salary becomes 181,000 USD, 32% more than the previous level.

Is a Master's degree or an MBA worth it? Should you pursue higher education?

A Master's degree program or any post-graduate program in United States costs anywhere from 39,600 USD to 119,000 USD and lasts approximately two years. That is quite an investment.

You can't really expect any salary increases during the study period, assuming you already have a job. In most cases, a salary review is conducted once education is completed and the degree has been attained.

Many people pursue higher education as a tactic to switch to a higher-paying job. The numbers seem to support the theory. The average increase in compensation while changing jobs is approximately 10% more than the customary salary increment.

If you can afford the costs of higher education, the return on investment is definitely worth it. You should be able to recover the costs in roughly a year or so.

Typical Salary Difference by Education for Most Careers

Salary and Compensation Comparison By Gender / Financial Analyst / United States

Though gender should not have an effect on pay, in reality, it does. So who gets paid more: men or women? For the people who work as Financial Analyst in United States, the average difference between the salary of male and female employees is 6%.

| Male | 129,000 USD | |

| Female | -5% | 122,000 USD |

Salary Comparison By Gender in United States for all Careers

Average Annual Salary Increment Percentage / Financial Analyst / United States

How much are annual salary increments in United States for individuals working as Financial Analyst? How often do employees get salary raises?

Individuals working as Financial Analyst in United States are likely to observe a salary increase of approximately 12% every 16 months. The national average annual increment for all professions combined is 8% granted to employees every 16 months.

United States / All Professions

The term Annual Salary Increase usually refers to the increase in 12 calendar month period, but because it is rare that people get their salaries reviewed exactly on the one-year mark, it is more meaningful to know the frequency and the rate at the time of the increase.

How to calculate the salary increment percentage?

The annual salary Increase in a calendar year (12 months) can be easily calculated as follows: Annual Salary Increase = Increase Rate x 12 / Increase Frequency

Worldwide Salary Raises: All Countries and All Jobs

Salary Packages and Schemes

Not all compensation increases are reflected directly in the salary. Some companies offer upgraded packages to their staff instead of cash money. The figures displayed here account only for direct increments to the base salary.

Bonus and Incentive Rates / Financial Analyst / United States

How much and how often are bonuses being awarded? Share This Chart Tweet Get Chart Linkhttp://www.salaryexplorer.com/charts/united-states/accounting-and-finance/financial-analyst/annual-salary-bonus-rate-united-states-financial-analyst.jpg

Share This Chart Tweet Get Chart Linkhttp://www.salaryexplorer.com/charts/united-states/accounting-and-finance/financial-analyst/annual-salary-bonus-rate-united-states-financial-analyst.jpg

46% of surveyed staff reported that they haven't received any bonuses or incentives in the previous year while 54% said that they received at least one form of monetary bonus.

Those who got bonuses reported rates ranging from 3% to 5% of their annual salary.

| Received Bonus | 54% | |

| No Bonus | 46% |

Types of Bonuses Considered

Individual Performance-Based BonusesThe most standard form of bonus, where the employee is awarded based on their exceptional performance.

Company Performance BonusesOccasionally, some companies like to celebrate excess earnings and profits with their staff collectively in the form of bonuses that are granted to everyone. The amount of the bonus will probably be different from person to person depending on their role within the organization.

Goal-Based BonusesGranted upon achieving an important goal or milestone.

Holiday / End of Year BonusesThese types of bonuses are given without a reason and usually resemble an appreciation token.

Bonuses Are Not Commissions!

People tend to confuse bonuses with commissions. A commission is a prefixed rate at which someone gets paid for items sold or deals completed while a bonus is in most cases arbitrary and unplanned.

What makes a position worthy of good bonuses and a high salary?

The main two types of jobs | |

| Revenue Generators | Supporting Cast |

Employees that are directly involved in generating revenue or profit for the organization. Their field of expertise usually matches the type of business. | Employees that support and facilitate the work of revenue generators. Their expertise is usually different from that of the core business operations. |

Example: | Example: |

Revenue generators usually get more and higher bonuses, higher salaries, and more frequent salary increments. The reason is quite simple: it is easier to quantify your value to the company in monetary terms when you participate in revenue generation.

Bonus Comparison by Seniority Level

Top management personnel and senior employees naturally exhibit higher bonus rates and frequencies than juniors. This is very predictable due to the inherent responsibilities of being higher in the hierarchy. People in top positions can easily get double or triple bonus rates than employees down the pyramid.

Average Hourly Wage / Financial Analyst / United States

60 USD per hour

60 USD per hourThe average hourly wage (pay per hour) for individuals working as Financial Analyst in United States is 60 USD.This is the rate they get paid for every worked hour.

About The Hourly Pay Rate

The hourly wage is the salary paid in one worked hour. Usually, jobs are classified into two categories: salaried jobs and hourly jobs. Salaried jobs pay a fixed amount regardless of the hours worked. Hourly jobs pay per worked hour. To convert salary into hourly wage the above formula is used (assuming 5 working days in a week and 8 working hours per day which is the standard for most jobs). The hourly wage calculation may differ slightly depending on the worked hours per week and the annual vacation allowance. The figures mentioned above are good approximations and are considered to be the standard. One major difference between salaried employees and hourly paid employees is overtime eligibility. Salaried employees are usually exempt from overtime as opposed to hourly paid staff.

What is the minimum hourly rate of pay?

The minimum pay rate per hour for people working as Financial Analyst in United States is 32 USD. This is the minimum as per the gathered data in the salary survey not the minimum hourly rate mandated by law.

Salary comparison with similar jobs

| Job Title | Average Salary |

| Accounting and Finance |  -100% -100% | |

| Account Examiner | 49,300 USD |  -61% -61% |

| Account Executive | 85,800 USD |  -32% -32% |

| Accountant | 65,700 USD |  -48% -48% |

| Accounting Analyst | 79,600 USD |  -37% -37% |

| Accounting Assistant | 52,900 USD |  -58% -58% |

| Accounting Associate | 49,200 USD |  -61% -61% |

| Accounting Clerk | 41,000 USD |  -67% -67% |

| Accounting Coordinator | 59,100 USD |  -53% -53% |

| Accounting Head | 136,000 USD |  +8% +8% |

| Accounting Manager | 141,000 USD |  +12% +12% |

| Accounting Officer | 49,500 USD |  -61% -61% |

| Accounting Specialist | 93,200 USD |  -26% -26% |

| Accounting Supervisor | 90,000 USD |  -28% -28% |

| Accounting Technician | 46,800 USD |  -63% -63% |

| Accounting Unit Controller | 112,000 USD |  -11% -11% |

| Accounts Executive | 90,600 USD |  -28% -28% |

| Accounts Officer | 55,400 USD |  -56% -56% |

| Accounts Payable and Receivable Specialist | 67,700 USD |  -46% -46% |

| Accounts Payable Assistant | 52,500 USD |  -58% -58% |

| Accounts Payable Associate | 64,000 USD |  -49% -49% |

| Accounts Payable Clerk | 50,800 USD |  -60% -60% |

| Accounts Payable Manager | 139,000 USD |  +11% +11% |

| Accounts Receivable Administrator | 103,000 USD |  -18% -18% |

| Accounts Receivable Clerk | 48,700 USD |  -61% -61% |

| Accounts Receivable Financial Analyst | 98,600 USD |  -22% -22% |

| Accounts Receivable Manager | 131,000 USD |  +4% +4% |

| Accounts Receivable Team Leader | 101,000 USD |  -20% -20% |

| Algorithmic Trading Specialist | 117,000 USD |  -7% -7% |

| Assistant Accountant | 51,200 USD |  -59% -59% |

| Assistant Accounting Manager | 123,000 USD |  -2% -2% |

| Assistant Auditor | 69,800 USD |  -44% -44% |

| Assistant Corporate Controller | 92,300 USD |  -27% -27% |

| Assistant Finance Manager | 144,000 USD |  +15% +15% |

| Assistant Financial Controller | 89,600 USD |  -29% -29% |

| Audit Director | 149,000 USD |  +19% +19% |

| Audit Supervisor | 129,000 USD |  +3% +3% |

| Auditing Clerk | 55,400 USD |  -56% -56% |

| Auditing Manager | 135,000 USD |  +7% +7% |

| Billing Clerk | 54,000 USD |  -57% -57% |

| Billing Coordinator | 60,100 USD |  -52% -52% |

| Billing Specialist | 73,700 USD |  -41% -41% |

| Billing Supervisor | 108,000 USD |  -14% -14% |

| Bookkeeper | 43,400 USD |  -65% -65% |

| Bookkeeping Specialist | 63,800 USD |  -49% -49% |

| Budget Analyst | 117,000 USD |  -7% -7% |

| Budget Manager | 144,000 USD |  +15% +15% |

| Business Support Analyst | 78,800 USD |  -37% -37% |

| Capital Markets Associate | 107,000 USD |  -15% -15% |

| Cash Flow Analyst | 98,100 USD |  -22% -22% |

| Cash Management Manager | 132,000 USD |  +5% +5% |

| Cash Management Officer | 79,100 USD |  -37% -37% |

| Cashbook Clerk | 45,800 USD |  -64% -64% |

| Chartered Accountant | 90,400 USD |  -28% -28% |

| Chief Accountant | 96,400 USD |  -23% -23% |

| Chief Financial Technology Officer | 135,000 USD |  +7% +7% |

| Collections Clerk | 42,500 USD |  -66% -66% |

| Collections Representative | 61,600 USD |  -51% -51% |

| Collections Specialist | 68,500 USD |  -46% -46% |

| Corporate Controller | 104,000 USD |  -17% -17% |

| Corporate Treasurer | 128,000 USD |  +2% +2% |

| Cost Accountant | 69,100 USD |  -45% -45% |

| Cost Accounting Manager | 137,000 USD |  +9% +9% |

| Cost Accounting Supervisor | 114,000 USD |  -9% -9% |

| Cost Analyst | 113,000 USD |  -10% -10% |

| Credit and Collection Manager | 139,000 USD |  +11% +11% |

| Credit and Collection Staff | 50,100 USD |  -60% -60% |

| Credit and Loans Officer | 47,900 USD |  -62% -62% |

| Credit Controller | 91,500 USD |  -27% -27% |

| Credit Manager | 142,000 USD |  +13% +13% |

| Debt Adviser | 115,000 USD |  -9% -9% |

| Debt Collector | 52,200 USD |  -58% -58% |

| Debtors Clerk | 45,000 USD |  -64% -64% |

| Debtors Controller | 49,500 USD |  -61% -61% |

| Deputy CFO | 184,000 USD |  +46% +46% |

| Deputy Head of Finance | 194,000 USD |  +54% +54% |

| Derivative Trader | 112,000 USD |  -11% -11% |

| Director of Finance | 198,000 USD |  +58% +58% |

| E-commerce Accountant | 70,300 USD |  -44% -44% |

| Economist | 153,000 USD |  +22% +22% |

| Equity Analyst | 122,000 USD |  -3% -3% |

| Escrow Assistant | 62,700 USD |  -50% -50% |

| Executive Accountant | 73,100 USD |  -42% -42% |

| External Auditor | 93,600 USD |  -26% -26% |

| Finance Administrator | 77,100 USD |  -39% -39% |

| Finance Analyst | 127,000 USD |  +1% +1% |

| Finance Associate | 59,200 USD |  -53% -53% |

| Finance Data Analyst | 111,000 USD |  -12% -12% |

| Finance Director | 207,000 USD |  +65% +65% |

| Finance Executive | 142,000 USD |  +13% +13% |

| Finance Licensing Clerk | 47,400 USD |  -62% -62% |

| Finance Licensing Manager | 129,000 USD |  +3% +3% |

| Finance Licensing Specialist | 75,300 USD |  -40% -40% |

| Finance Manager | 183,000 USD |  +46% +46% |

| Finance Officer | 64,600 USD |  -49% -49% |

| Finance President | 194,000 USD |  +54% +54% |

| Finance Relationship Manager | 157,000 USD |  +25% +25% |

| Finance Release Analyst | 75,600 USD |  -40% -40% |

| Finance Specialist | 111,000 USD |  -12% -12% |

| Finance Team Leader | 148,000 USD |  +18% +18% |

| Financial Accountant | 66,500 USD |  -47% -47% |

| Financial Actuary | 104,000 USD |  -17% -17% |

| Financial Administrator | 113,000 USD |  -10% -10% |

| Financial Advisor | 125,000 USD |  -1% -1% |

| Financial Analyst | 126,000 USD |  +0% +0% |

| Financial Applications Specialist | 85,900 USD |  -32% -32% |

| Financial Assistant | 56,900 USD |  -55% -55% |

| Financial Associate | 67,900 USD |  -46% -46% |

| Financial Claims Analyst | 89,200 USD |  -29% -29% |

| Financial Claims Manager | 121,000 USD |  -4% -4% |

| Financial Claims Supervisor | 116,000 USD |  -8% -8% |

| Financial Clerk | 52,500 USD |  -58% -58% |

| Financial Commercial Analyst | 97,100 USD |  -23% -23% |

| Financial Compliance Analyst | 114,000 USD |  -9% -9% |

| Financial Compliance Officer | 112,000 USD |  -11% -11% |

| Financial Consultant | 94,900 USD |  -25% -25% |

| Financial Controller | 105,000 USD |  -16% -16% |

| Financial Coordinator | 64,000 USD |  -49% -49% |

| Financial Customer Service Manager | 128,000 USD |  +2% +2% |

| Financial Data Scientist | 123,000 USD |  -2% -2% |

| Financial Dealer and Broker | 73,300 USD |  -42% -42% |

| Financial Director | 196,000 USD |  +56% +56% |

| Financial Encoder | 56,600 USD |  -55% -55% |

| Financial Manager | 181,000 USD |  +44% +44% |

| Financial Modelling Analyst | 122,000 USD |  -3% -3% |

| Financial Operations Manager | 177,000 USD |  +41% +41% |

| Financial Policy Analyst | 102,000 USD |  -19% -19% |

| Financial Project Manager | 142,000 USD |  +13% +13% |

| Financial Quantitative Analyst | 122,000 USD |  -3% -3% |

| Financial Reporting Consultant | 99,100 USD |  -21% -21% |

| Financial Reporting Manager | 126,000 USD |  +0% +0% |

| Financial Section Head | 130,000 USD |  +3% +3% |

| Financial Services Manager | 170,000 USD |  +35% +35% |

| Financial Services Sales Agent | 74,900 USD |  -40% -40% |

| Financial Technology Consultant | 110,000 USD |  -12% -12% |

| Financial Wellness Coach | 134,000 USD |  +7% +7% |

| FinTech Analyst | 115,000 USD |  -9% -9% |

| Fixed Assets Administrator | 72,100 USD |  -43% -43% |

| Forensic Accountant | 79,100 USD |  -37% -37% |

| Fraud Detection Supervisor | 80,600 USD |  -36% -36% |

| Fraud Prevention Manager | 137,000 USD |  +9% +9% |

| Fund Accountant | 66,300 USD |  -47% -47% |

| Grants Coordinator | 50,600 USD |  -60% -60% |

| Green Finance Analyst | 99,800 USD |  -21% -21% |

| Group Financial Manager | 196,000 USD |  +56% +56% |

| Internal Auditor | 92,000 USD |  -27% -27% |

| Internal Control Adviser | 103,000 USD |  -18% -18% |

| Internal Control Officer | 58,700 USD |  -53% -53% |

| International Tax Director | 166,000 USD |  +32% +32% |

| Inventory Accountant | 70,300 USD |  -44% -44% |

| Investment Advisor | 173,000 USD |  +38% +38% |

| Investment Analyst | 131,000 USD |  +4% +4% |

| Investment Associate | 114,000 USD |  -9% -9% |

| Investment Broker | 115,000 USD |  -9% -9% |

| Investment Fund Manager | 156,000 USD |  +24% +24% |

| Investment Operations Manager | 157,000 USD |  +25% +25% |

| Investment Underwriter | 55,500 USD |  -56% -56% |

| Investor | 85,300 USD |  -32% -32% |

| Investor Relations Manager | 137,000 USD |  +9% +9% |

| KYC Team Leader | 134,000 USD |  +7% +7% |

| Loan Processor | 54,500 USD |  -57% -57% |

| Management Accountant | 78,800 USD |  -37% -37% |

| Management Economist | 158,000 USD |  +26% +26% |

| Paymaster | 54,300 USD |  -57% -57% |

| Payroll Administrator | 85,300 USD |  -32% -32% |

| Payroll Benefits Coordinator | 73,300 USD |  -42% -42% |

| Payroll Billing Manager | 125,000 USD |  -1% -1% |

| Payroll Clerk | 58,100 USD |  -54% -54% |

| Payroll Manager | 125,000 USD |  -1% -1% |

| Payroll Officer | 61,200 USD |  -51% -51% |

| Payroll Specialist | 68,200 USD |  -46% -46% |

| Payroll Supervisor | 90,000 USD |  -28% -28% |

| Pensions Administrator | 72,000 USD |  -43% -43% |

| Personal Financial Advisor | 104,000 USD |  -17% -17% |

| Pricing Analyst | 114,000 USD |  -9% -9% |

| Private Equity Analyst | 126,000 USD |  +0% +0% |

| Project Accountant | 73,500 USD |  -42% -42% |

| Proposal Development Coordinator | 60,500 USD |  -52% -52% |

| Quantitative Trader | 93,900 USD |  -25% -25% |

| Receivables Accountant | 60,600 USD |  -52% -52% |

| Regulatory Accountant | 76,200 USD |  -39% -39% |

| Retirement Plan Analyst | 104,000 USD |  -17% -17% |

| Revenue Management Specialist | 112,000 USD |  -11% -11% |

| Revenue Recognition Analyst | 120,000 USD |  -5% -5% |

| Risk Management Director | 156,000 USD |  +24% +24% |

| Risk Management Supervisor | 132,000 USD |  +5% +5% |

| Staff Accountant | 65,200 USD |  -48% -48% |

| Tax Accountant | 66,800 USD |  -47% -47% |

| Tax Administrator | 74,700 USD |  -41% -41% |

| Tax Advisor | 108,000 USD |  -14% -14% |

| Tax Analyst | 101,000 USD |  -20% -20% |

| Tax Associate | 56,000 USD |  -55% -55% |

| Tax Consultant | 108,000 USD |  -14% -14% |

| Tax Director | 162,000 USD |  +29% +29% |

| Tax Examiner | 74,400 USD |  -41% -41% |

| Tax Manager | 140,000 USD |  +11% +11% |

| Tax Research Manager | 144,000 USD |  +15% +15% |

| Teller | 39,300 USD |  -69% -69% |

| Treasury Accountant | 70,800 USD |  -44% -44% |

| Treasury Analyst | 112,000 USD |  -11% -11% |

| Underwriter | 48,500 USD |  -61% -61% |

| Underwriting Assistant | 46,800 USD |  -63% -63% |

| Vice President of Finance | 179,000 USD |  +42% +42% |

Salary Comparison By City

| City | Average Salary |

| Boston | 124,000 USD |

| Chicago | 142,000 USD |

| Houston | 146,000 USD |

| Las Vegas | 122,000 USD |

| Los Angeles | 153,000 USD |

| New York | 145,000 USD |

| San Francisco | 130,000 USD |

| San Jose | 132,000 USD |

Salary Comparison By State

| State | Average Salary |

| Alabama | 129,000 USD |

| Alaska | 114,000 USD |

| Arizona | 137,000 USD |

| Arkansas | 116,000 USD |

| California | 135,000 USD |

| Colorado | 123,000 USD |

| Connecticut | 121,000 USD |

| Delaware | 114,000 USD |

| District of Columbia | 113,000 USD |

| Florida | 142,000 USD |

| Georgia | 128,000 USD |

| Hawaii | 111,000 USD |

| Idaho | 112,000 USD |

| Illinois | 135,000 USD |

| Indiana | 130,000 USD |

| Iowa | 122,000 USD |

| Kansas | 123,000 USD |

| Kentucky | 129,000 USD |

| Louisiana | 118,000 USD |

| Maine | 110,000 USD |

| Maryland | 126,000 USD |

| Massachusetts | 128,000 USD |

| Michigan | 134,000 USD |

| Minnesota | 129,000 USD |

| Mississippi | 123,000 USD |

| Missouri | 133,000 USD |

| Montana | 108,000 USD |

| Nebraska | 113,000 USD |

| Nevada | 117,000 USD |

| New Hampshire | 114,000 USD |

| New Jersey | 134,000 USD |

| New Mexico | 120,000 USD |

| New York | 142,000 USD |

| North Carolina | 127,000 USD |

| North Dakota | 105,000 USD |

| Ohio | 131,000 USD |

| Oklahoma | 121,000 USD |

| Oregon | 123,000 USD |

| Pennsylvania | 138,000 USD |

| Rhode Island | 115,000 USD |

| South Carolina | 130,000 USD |

| South Dakota | 106,000 USD |

| Tennessee | 125,000 USD |

| Texas | 136,000 USD |

| Utah | 117,000 USD |

| Vermont | 110,000 USD |

| Virginia | 135,000 USD |

| Washington | 135,000 USD |

| West Virginia | 122,000 USD |

| Wisconsin | 122,000 USD |

| Wyoming | 105,000 USD |

Government vs Private Sector Salary Comparison

Where can you get paid more, working in a private company or the government? The difference between the public or government sector salaries and the private sector salaries in United States is 5% on average across all career fields.

| Private Sector | 92,800 USD | |

| Public Sector | +5% | 97,500 USD |

Salary Statistics and Calculation Guide

What is considered to be a good and competitive salary for the job title Financial Analyst in United States?

A good and competitive compensation would range anywhere between 113,000 USD and 128,000 USD. This is a very rough estimate. Experience and education play a very huge part in the final earnings.

Gross Salary (before tax) and Net Salary (after tax)

All salary and compensation figures displayed here are gross salary figures, that is the salary before tax deductions. Because taxes may differ across sectors and locations, it is difficult to accurately calculate the net salary after tax for every career.

Base / Basic Salary

The base salary for a careers like Financial Analyst in United States ranges from 66,600 USD to 94,400 USD. The base salary depends on many factors including experience and education. It is not easy to provide a figure with very little information, so take this range with a grain of salt.

What is the difference between the median and the average salary?

Both are indicators. If your salary is higher than both the average and the median then you are doing very well. If your salary is lower than both, then many people earn more than you and there is plenty of room for improvement. If your wage is between the average and the median, then things can be a bit complicated. We wrote a guide to explain all about the different scenarios. How to compare your salary